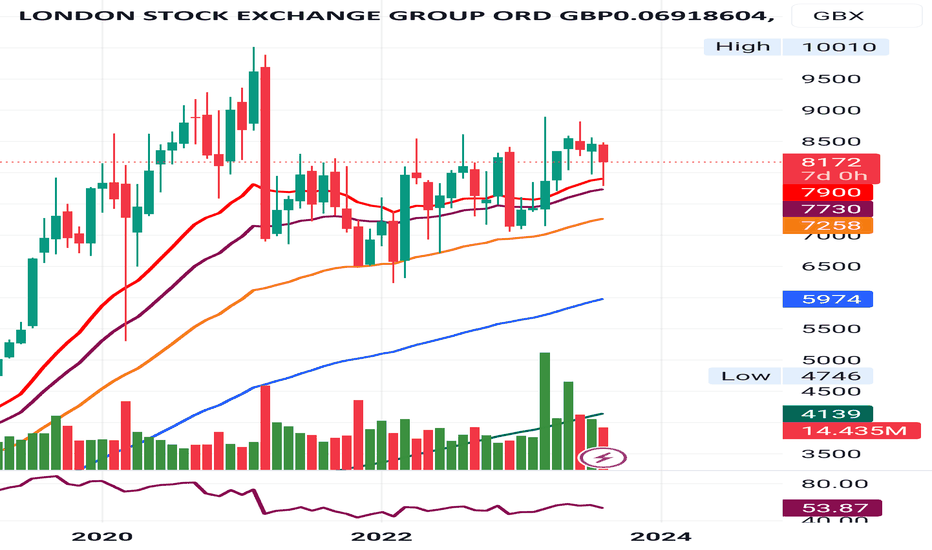

The London Stock Exchange: A Global Leader in Capital Markets

One of the most prominent and significant financial organizations in the world is the London Stock Exchange (LSE). With almost three centuries of existence, the LSE is a major player in international investing, capital raising, and finance. The construction, operations, and significance of the London Stock Exchange are examined in this article, along with its place in the modern, dynamic financial system.

Introduction to the London Stock Exchange

A leading international marketplace for securities, including stocks, bonds, exchange-traded funds (ETFs), and derivatives, the London Stock Exchange is based in London, United Kingdom. It belongs to the London Stock Exchange Group (LSEG), which also controls important financial market infrastructures including Borsa Italianas.

History and Evolution of the LSE

Although it was founded in 1801, its origins may be found in 1698 when it began business at Jonathan’s Coffee House.In the 1980s, electronic trading platforms replaced traditional trading floors .formed the London Stock Exchange Group (LSEG) through a 2007 merger with Borsa Italiana

History and Evolution of the LSE

Origins and Milestones

- Founded in 1801, but its roots trace back to 1698 with trading at Jonathan’s Coffee House.

- Transitioned from physical trading floors to electronic trading platforms in the 1980s.

- Merged with Borsa Italiana in 2007, forming the London Stock Exchange Group (LSEG).

Impact of Historical Events

The LSE has survived and adapted through significant events such as:

- The World Wars

- The Great Depression

- The 2008 Global Financial Crisis

- Brexit

Structure and Operations of the LSE

Main Market vs AIM

- Main Market: Home to established, large-cap companies that meet stringent regulatory and disclosure standards.

- Alternative Investment Market (AIM): Designed for smaller, growth-oriented businesses with more flexible regulatory requirements.

Trading Hours and Systems

Structure and Operations of the LSE

Main Market vs AIM

- Main Market: Home to established, large-cap companies that meet stringent regulatory and disclosure standards.

- Alternative Investment Market (AIM): Designed for smaller, growth-oriented businesses with more flexible regulatory requirements.

Trading Hours and Systems

- Operates on SETs (Stock Exchange Electronic Trading Service) platform.

- Trading Hours: 8:00 AM to 4:30 PM (London Time), Monday to Friday.

- Uses electronic order books to match buy and sell orders.

Key Products and Instruments Traded

Equities

- UK and international company shares.

- Examples: HSBC, BP, GlaxoSmithKline, Unilever.

Bonds

- Government gilts and corporate bonds.

- Facilitates debt financing for public and private entities.

ETFs and Investment Funds

- Growing market for Exchange Traded Funds and other pooled investment vehicles.

Derivatives and Indices

- Includes futures, options, and indices like the FTSE 100, a key barometer of UK market performance

Importance of the LSE in the Global Economy

Capital Formation

The LSE helps businesses raise capital through Initial Public Offerings (IPOs) and secondary offerings.

Investor Access

Provides global investors with access to a wide range of asset classes in one of the world’s most trusted markets.

Economic Stability and Transparency

Its robust regulatory framework and transparency promote investor confidence and financial stability.

Regulation and Governance

Role of the Financial Conduct Authority (FCA)

The FCA oversees market conduct and ensures compliance with legal and ethical standards.

Listing Requirements

Strict requirements for financial reporting, corporate governance, and disclosure to maintain market integrity.

Challenges and Future Outlook

Post-Brexit Impact

Brexit has led to some shifts in European market dynamics, but the LSE remains a resilient and globally respected institution.

Technological Innovation

LSEG is investing heavily in fintech, data analytics, and AI-driven trading platforms to maintain its competitive edge.

ESG and Sustainable Investing

The LSE is a leader in supporting green finance and Environmental, Social, and Governance (ESG) listings.

Conclusion: Why the London Stock Exchange Matters

The London Stock Exchange is more than just a marketplace; it is a cornerstone of global finance. From enabling capital formation and investment opportunities to fostering transparency and innovation, the LSE continues to shape the financial world. Whether you’re an investor, a startup seeking funding, or a policymaker, understanding the LSE’s operations and significance is crucial in navigating today’s interconnected economy.